Vinods non-senior citizen net taxable income is Rs 1200000 in the. Kuala Lumpur Kepong Berhad KLK is a company incorporated in Malaysia and listed on the Main Market of Bursa Malaysia Securities Berhad with a market capitalisation of approximately RM21687 billion at the end of September 2021.

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

A normal hours of work means the number of hours of work not exceeding the limits applicable to an employee under section 38 or 40 as the case may be that is agreed between an employer and an employee to be the usual hours of work per day.

. If you opt for none of them and hold no valid pass or permit to stay in Malaysia you are committing a criminal offence under section 63 of the Immigration Act 195963 Act 155. With one of these best payroll software in Malaysia you will surely be able to focus more on growing your company and free yourself from the drudgery of payroll calculation and management. The Malaysia Employment Act 1995 has been the rulebook for Malaysian companies.

In the Accounting menu. ID For the purposes of payment of sick leave under section 60F the calculation of the ordinary rate of pay of an employee employed on a daily rate of pay or on piece rates under subsection. Basic salary x 20 premium pm.

The president of the United States appoints individuals to these positions most with the advice and consent of the United States SenateThey include members of the presidents Cabinet several top-ranking officials of. Must pay the employee at least half the employees salary during the period the employee is suspended from work. Or in the absence of any such agreement is deemed to be 8 hours a day.

A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019. The actual contribution amount follows Section 18 Second Schedule of the Employment Insurance Act 2017 not the exact 02 percent calculation. When should EIS contribution be paid.

Lets understand the steps involved to calculate relief from salary arrears under Section 891 citing an example. Manual or automatedcomputerised distribution. The base salary is lower than Rs7000 so we consider the real base salary of Rs6800 for the calculation of the bonus.

Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Second Schedule of the Employment Insurance System Act 2017 instead of using the exact percentage calculation. Disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if youve sold any. Advance Tax Calculation Advance Tax Liabilty calculator.

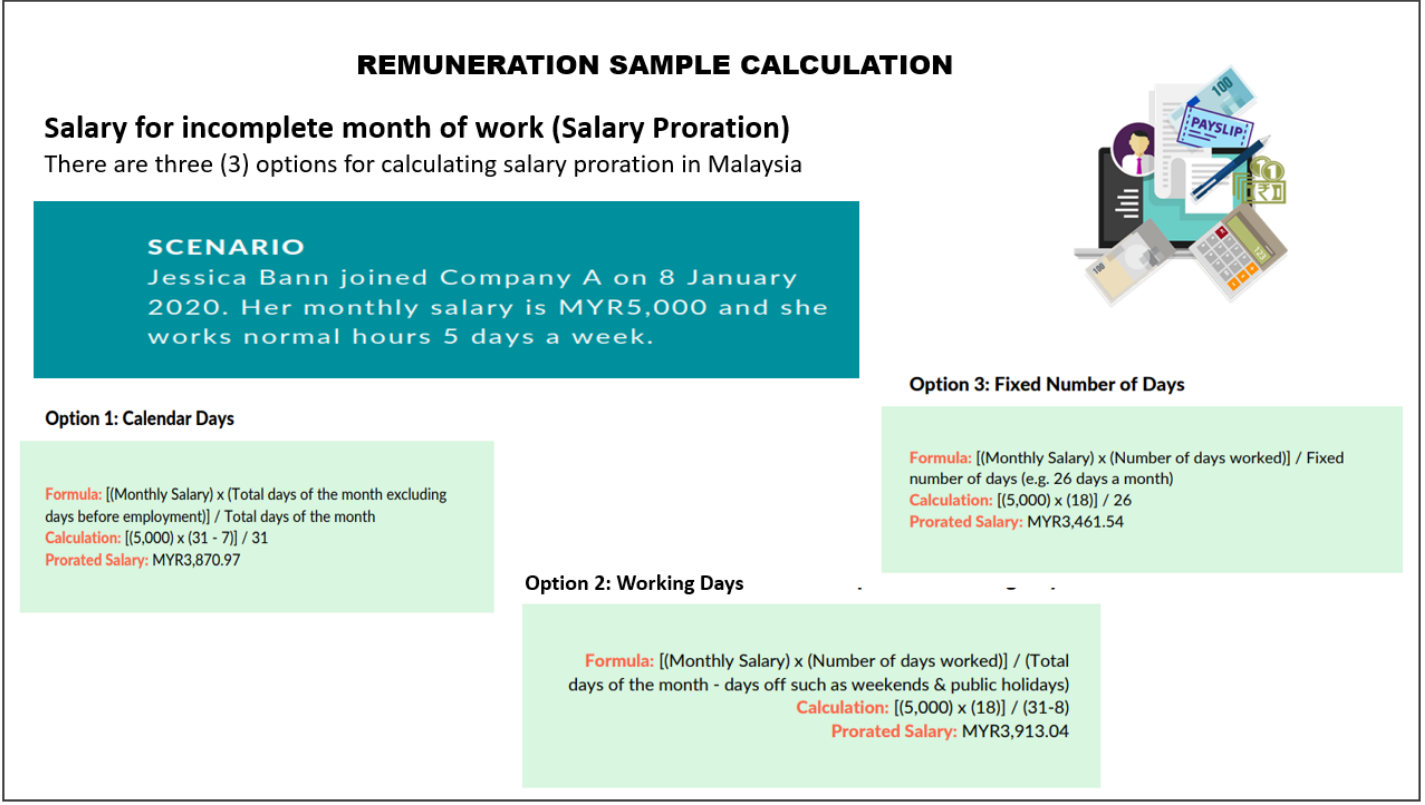

Please do not simply calculate 02 x Your Monthly Salary. When an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. You can gain a lot of human resource knowledge eg.

The member of the Fund is physically or mentally incapacitated from engaging in an employment. Has zero for Days per week in their salary or wages line in Employment. With this amendment any employee without a salary cap is allowed to bring a claim before the Director General of Labour Labour Department.

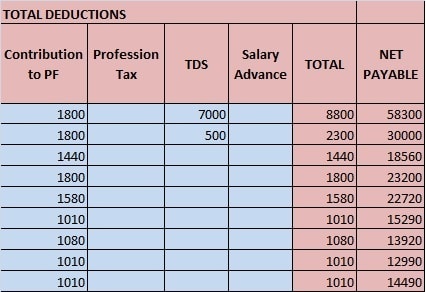

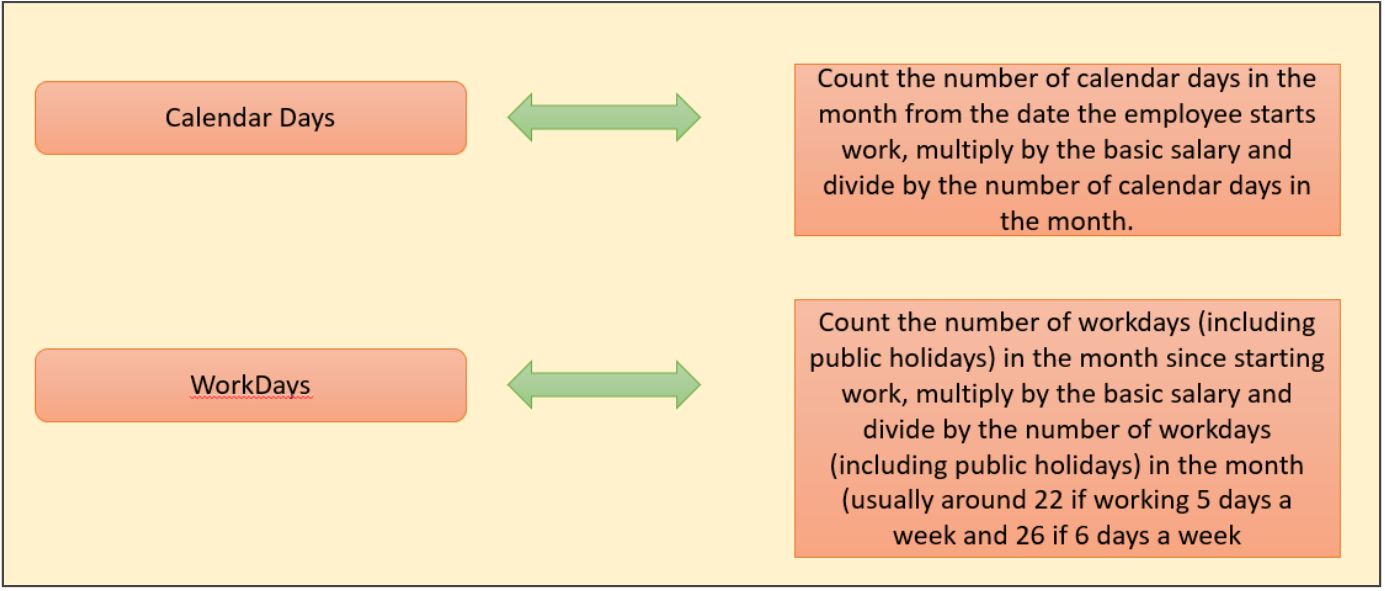

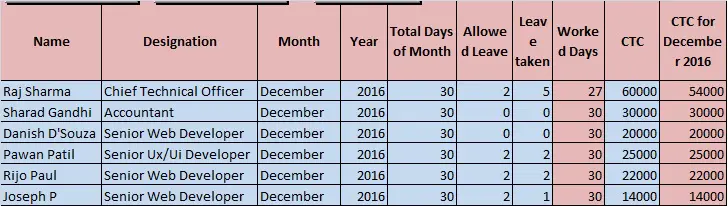

Salary Calculation for Incomplete Month. Incorporating overtime sick pay etc. This not only includes your monthly salary.

The amendments are intended to provide further protection to all employees regardless of income level. That the payment amount must be calculated by using the contribution rate mentioned in the second schedule of the Employment Insurance System Act 2017. If you dont pay advance tax then you might levy interest under section 234C and 234B of the Income Tax Act 1961.

Executive Schedule 5 USC. The Salary of a monthly rated employee is apportioned base on the number of days in the respective calendar month. However it is to note that Malaysias labor law applies to only those whose salary does not exceed RM1500 per month.

An Act to provide for the Employment Insurance Scheme implemented from 1 January 2018. Advance tax payment on non-TDS deducted income from self-employment professional service business capital gains or any other source. Act A15042016 the member of the Fund has attained the age of fifty-five years.

Hence dont calculate using the precise percentage calculation. The Employment Act 1955 has a salary cap of employees RM5000 who can bring a claim before the Director General of Labour. Short title and application.

53115318 is the system of salaries given to the highest-ranked appointed officials in the executive branch of the US. To check an employees Holiday Pay balance. The maximum monthly contribution per month is set at RM4.

The monthly contribution is capped at a monthly salary of RM4000. This offence is punishable by a fine of not more than RM10000 or imprisonment not exceeding five years or both and shall also be liable to whipping of not more than 6 strokes. 10 percent for employees entitled to five weeks annual leave if the fifth week is subject to the holidays act rules.

The base salary is above Rs7000 but below the minimum wage. Malaysias Labor Law on Normal Working Hours VS Overtime. THIRD SCHEDULE Calculation of gross and basic rates of pay of an employee employed on a monthly rate or on piece rates FOURTH SCHEDULE.

Tax calculation EPF etc for Malaysia and other countries Damansara Utama. Summary Changes have been made to the Malaysian Employment Act 1955 EA 1955. Therefore the amount reflected on your payslip will not be exactly 02 percent of your salarywages gaji.

Act A15042016 the member of the Fund is about to leave Malaysia and has no intention of returning to Malaysia. 7000 x 20 1400 16800 pa 7000 x 833 583 6996 pa The base salary is more than 7000 and also the. Then the calculation is 130 days divided by 365 days per year.

Employment Insurance Scheme EIS in Malaysia. PART I - PRELIMINARY.

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Reference Letter For Apartment Template Free Pdf Google Docs Word Template Net Personal Reference Letter Reference Letter Writing A Reference Letter

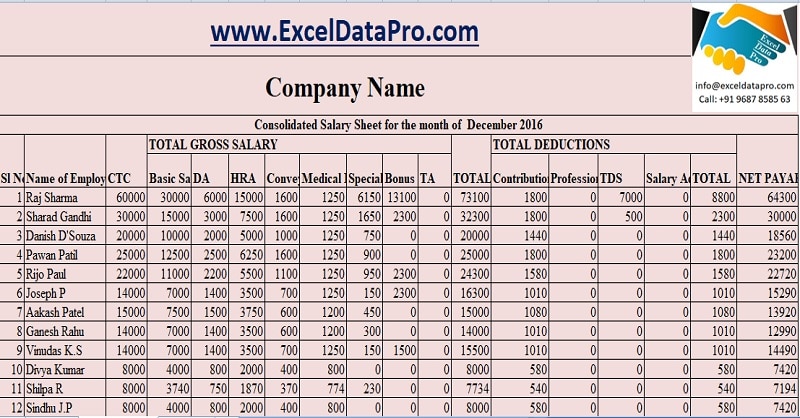

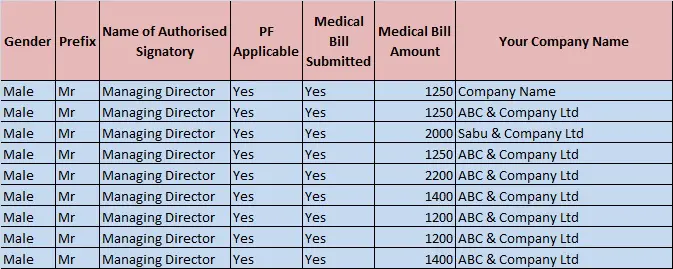

Download Salary Sheet Excel Template Exceldatapro

Payroll Journal Entries For Wages Accountingcoach

Employees Earning Up To Rm4 000 Month Will Be Entitled To Overtime Payments Here S What Employers Need To Know

Payroll Journal Entries For Wages Accountingcoach

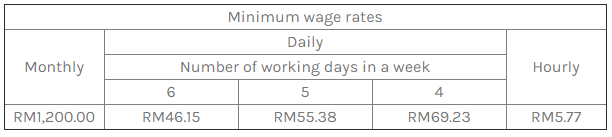

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Everything You Need To Know About Running Payroll In Malaysia

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Salary Formula Calculate Salary Calculator Excel Template

Everything You Need To Know About Running Payroll In Malaysia

Salary Formula Calculate Salary Calculator Excel Template

Download Salary Sheet Excel Template Exceldatapro

Download Salary Sheet Excel Template Exceldatapro

Service Contract Offer Letter How To Draft A Service Contract Offer Letter Download This Service Contract Lettering Download Letter Example Letter Templates

Download Salary Sheet Excel Template Exceldatapro

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

How To Do Payroll In Excel In 7 Steps Free Template